On Monday, every adult in the country became eligible for the COVID vaccine.

More than 40% of the U.S. population—including more than half of all adults—have received at least one dose, according to the CDC.

But it’s too early to rest on our laurels… or stop accounting for COVID in our future outlook.

It seems increasingly likely countries all over the world will vaccinate people annually, just like we do for the flu… or keep vaccines stockpiled in case of another outbreak.

COVID vaccines will be an ongoing presence in the healthcare industry… and an ongoing business for companies involved.

Today, we’ll talk about a company that will continue to play a vital role in the ongoing fight against COVID. If you don’t own this name yet, it’s time to take a look…

Corning (GLW)—the king of glass—is known for Corning, Pyrex, Gorilla Glass, and other branded products. It’s been involved in vaccine manufacturing because of its expertise in glass and ceramic science… manufacturing capacity… and history of creating the best glass for the job.

To fight COVID, Corning has contributed new technologies—from manufacturing consumables… to helping Big Pharma develop treatments and vaccines… to making specialty glass for vaccine production.

And it owns the newest glass there is—one specifically designed for pharmaceutical applications.

It’s called Valor Glass.

In October 2019, Valor Glass became the first pharmaceutical glass composition to be approved by the FDA in more than 100 years.

That’s because, thanks to its unique properties, it helps speed up the manufacturing process of the vaccines.

A vial made from conventional glass is more brittle. Because it’s prone to breakage and delamination (glass flakes contaminating the vial’s contents), manufacturers cannot increase the manufacturing process above certain limits.

Vials made from Valor Glass are many times stronger than conventional vials, and much less likely to contaminate the liquid inside the vials via delamination. Thanks to these qualities, manufacturers can double up the speed of the assembly lines… from 300–400 vials per minute to about 750.

Early last year, Corning entered a long-term supply agreement to provide Valor Glass vials for Pfizer’s already marketed drugs.

In June 2020, the U.S. government awarded Corning $204 million to substantially expand domestic manufacturing capacity for Valor vials.

And less than a month ago, Corning announced an additional $57 million from the Biomedical Advanced Research and Development Authority (BARDA), which it will use to expand its production of pharmaceutical glass—including the much-needed Valor.

Today, Corning is supplying Valor Glass to several leading COVID vaccine manufacturers. At year-end 2020, the company already shipped enough Valor vials for more than 100 million doses.

Mass testing is another activity that isn’t likely to go away anytime soon. Corning has a hand in the testing technologies as well consumable products. The company received $15 million from the U.S. government to expand domestic capacity for robotic pipette tips, which are used for COVID diagnostic testing.

All of the above are part of the Life Sciences division.

But Corning is a large, diverse company, with four divisions larger than Life Sciences:

- Specialty Materials, which largely serves the IT industry and is set to benefit from the growing demand for semiconductors…

- Optical Networks, where growth is set to accelerate as we spend more on infrastructure…

- Environmental Technologies, which makes, among other things, various filters for emission control. A temporary slowdown in this division is possible… but as car manufacturers restart production following a semiconductor shortage, profits here will take off.

- Displays, which produces TV and computer monitor glass. This is where Corning makes most of its money, accounting for some 30% of revenue and 40% of net income.

The Displays division is leveraged to consumer spending. A stronger consumer, supported by more stimulus and the rebounding economy, means the retail demand for TVs, smartphones, and other electronics will only accelerate.

That’s good news.

And here’s more: In early April, Corning announced it’s extending its long-term relationship with Samsung, a Corning investor since 2014.

The new deal calls for Samsung Display (a subsidiary of the South Korean consumer electronics giant Samsung) to convert all of its preferred shares into stock—which would increase its ownership stake in Corning… and sell some of the stock back to the company. All said, the Samsung stake will increase from the current 7.4% to 9%…

That Samsung converted its preferred shares to stock is great news: it’s cheaper for Corning (it’ll pay Samsung smaller dividends with common shares). Plus, Samsung will hold onto its stake until at least 2028… showing its growing confidence in the Corning partnership.

In sum, Corning is positioned to ride several growth trends for 2021 and beyond: Valor Glass vaccine vials… optical communications growth, driven by strong growth in data centers and the cloud… stronger demand for environmental protection (both here and in China, where new regulations have been enacted)… growing consumer demand for electronics… and IT manufacturers’ insatiable need for semiconductor materials.

The company didn’t have to cut or suspend its dividend in the tough business environment of 2020. In fact, it’s steadily increased its dividend over the last decade, and is now yielding 2.1% (vs. the market’s 1.4%).

Plus, the stock is still cheap, trading at only 20 times (20x) next year’s earnings (vs. the market’s 23.5x).

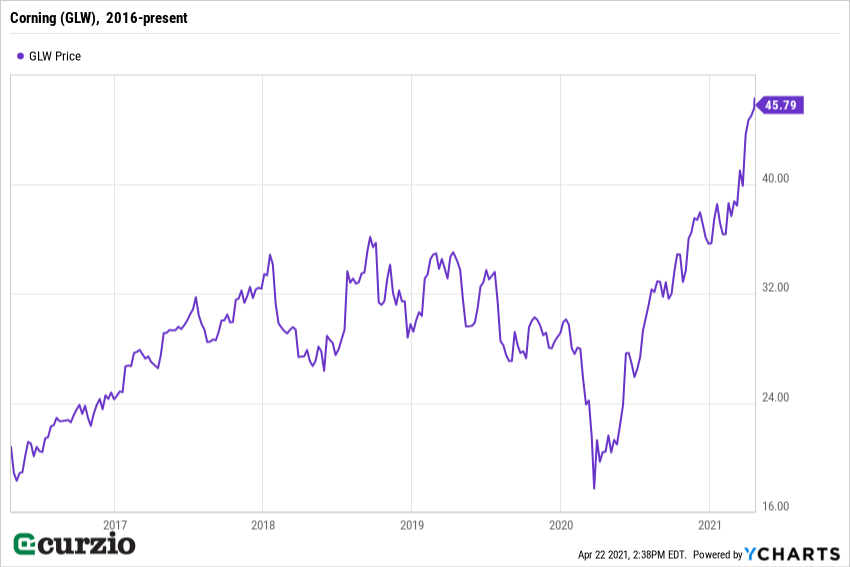

While GLW is up 27% this year alone, there’s still room to go, thanks to the growth positioning, the Samsung deal, and the stock’s attractive valuation.

Corning’s profit growth is expected to be around 14% annually for the next few years—and while this growth isn’t priced in yet, several analysts have already raised their price targets on the stock. If you don’t own GLW, now is a great time… before its next growth leg is fully in place.

Editor’s note:

Unlimited Income members who followed Genia’s advice on GLW are already up over 25%… and as she explained today, there are big catalysts for more upside ahead.

Over and over again, Genia’s shown you don’t have to sacrifice growth to earn income… Out of the 17 stocks in her income portfolio, 16 are winners…

Here’s how you can get all her recommendations… for an incredible 66% off.