There’s nothing like a crisis to propel us to new heights…

With the end of WWI in 1918, nations began to rebuild… and adopt new technologies inspired by the needs of a worldwide conflict.

In the U.S., the next decade ushered in a cultural and economic boom. The “Roaring ’20s,” as they became known, saw women raising their hemlines… the dawn of jazz… the Ford Model A… and stunning architectural achievements like the Chrysler Building and the Hollywood Bowl.

The stock market went parabolic… largely thanks to the incredible economy.

As you’ll see, the parallels between the world today and 100 years ago are uncanny. So much so that the pundits are hailing the new decade “the Roaring ’20s 2.0.”

And the stock market is already pricing in this “roaring” economic comeback.

Today, I’ll tell you why the economy is set to bounce back with vengeance… three sectors to benefit from the recovery… and how to invest in “the next Roaring ’20s” for maximum profit.

Similar to the post-WWI period, the needs arising from the COVID crisis have vastly accelerated many trends already in the works. More and more new technologies are going mainstream. It’s adoption “on steroids”—with the COVID crisis serving as a massive, powerful push.

Cloud computing had existed long before the crisis. But it has become a necessity when most offices closed and companies moved their personnel to a new work-from-home format.

Zoom wasn’t invented yesterday… but it became a star almost overnight, when the crisis created a sudden need for a flexible and easy-to-use communication tool.

And the post-COVID second coming of cryptocurrency is the 21st century answer to massive money printing—the traditional policy response to an almost inevitable economic and market collapse.

But one of the most exciting examples of accelerated technology is messenger RNA (mRNA). It’s the tech behind the incredible success of the Pfizer and Moderna vaccines… and it’s only a decade or so old.

The COVID crisis has made it possible to move very quickly with mRNA applications, much faster than would have been possible in a normal environment. Today, in addition to the hundreds of millions of COVID vaccine doses administered, mRNA technology is being tested on a variety of incurable diseases, such as multiple sclerosis.

The world is beating back COVID… creating better cancer treatments… printing 3D organs… and using robots as surgical assistants.

Renewable power generation is replacing fossil fuels faster and faster… electric cars are all the rage… and delivery companies are about to start using drones to drop off your next purchase right at your doorstep.

Meanwhile, to combat the economic effects of COVID, the Fed has flooded the system with money… Congress has enacted a record $1.9 trillion stimulus package… and another $2.25 trillion is about to be spent on infrastructure, green energy, manufacturing, and housing.

This market is driven by record-low rates (and the Fed’s promise to keep them there for longer) and high liquidity (also with us indefinitely). These factors are good for stocks.

The economy is getting all the help it can get… and then some. And we’re doing this faster than other developed countries.

The net result: Not only are we going to see a strong recovery soon… we’re also likely to get significant competitive advantages on the international front in the process.

Still, as exciting as these new developments are, I’d remain on market high alert in the short term.

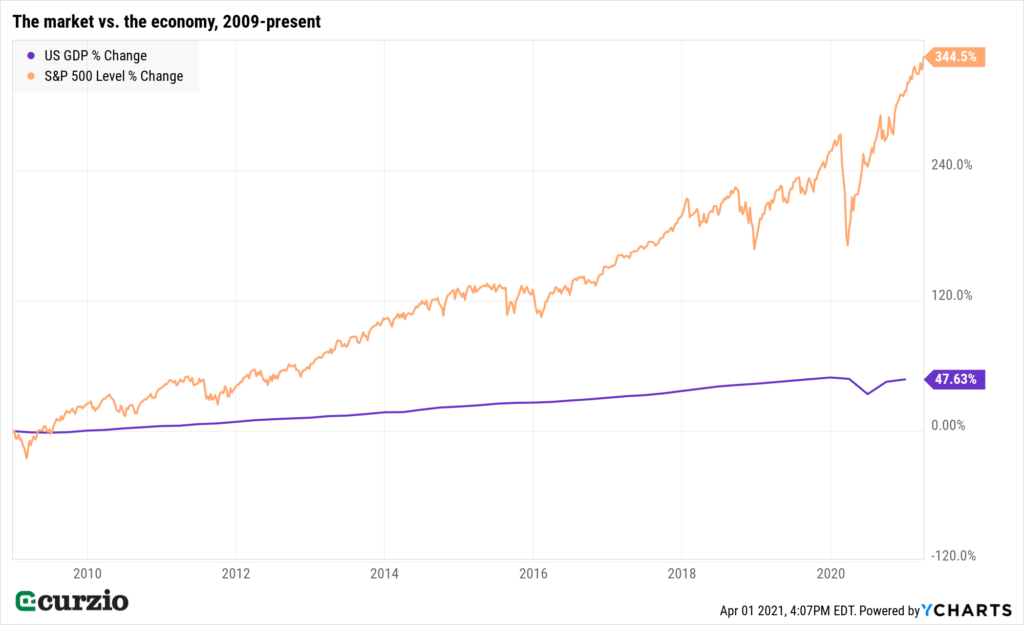

That’s because much of the new growth is already priced into stocks.

There are still recovery plays out there, especially if you’re focusing on the right sectors… and right stocks. But for the overall market to feel safe, we want to make sure growth will accelerate materially.

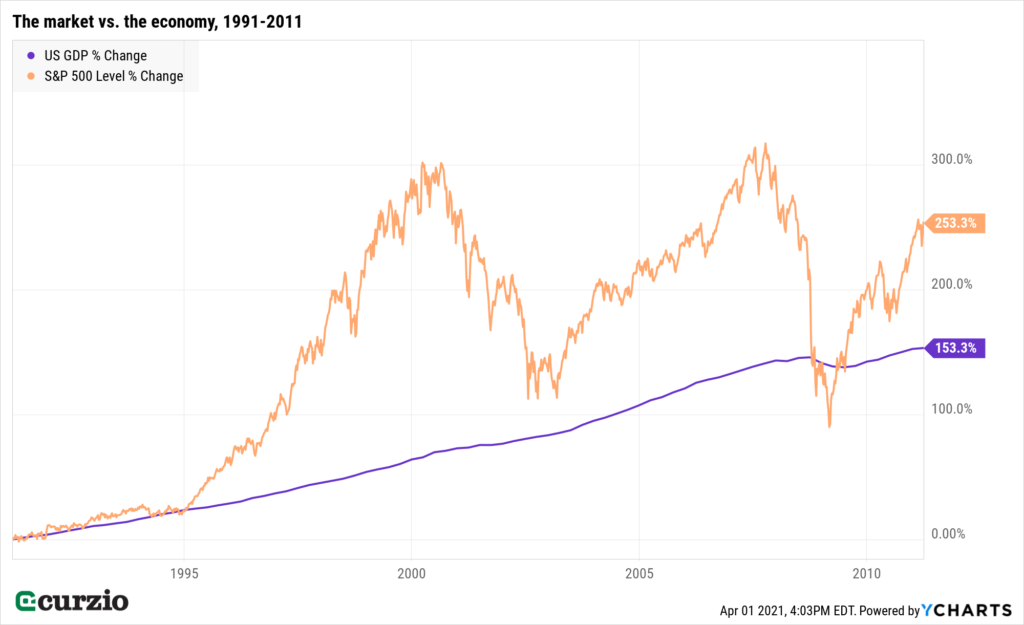

That’s because every large disconnect between the U.S. gross domestic product (GDP) and the S&P 500 has eventually corrected.

Just look at the chart below.

The time period it covers is 1991–2011.

Every time market growth gets too far removed from the economy, the market eventually brings the two back to equilibrium.

The additional $2.25 trillion in infrastructure spending, albeit spread over 10 years, is going to give GDP a boost… potentially moving the blue line on the chart below higher. This will make the disconnect between the market and the GDP less glaring—reducing the need for the market to correct… and making long-term investing safer and long-term valuations more comfortable.

So, be optimistic but careful with your investments. Remember: At the end of the Roaring ’20s, markets crashed.

Buy quality stocks—ones you plan to own for years to come. Or selectively own stocks and sectors that will benefit from long-term spending trends.

To benefit from “the new Roaring ’20s” spending, consider these three major investment themes…

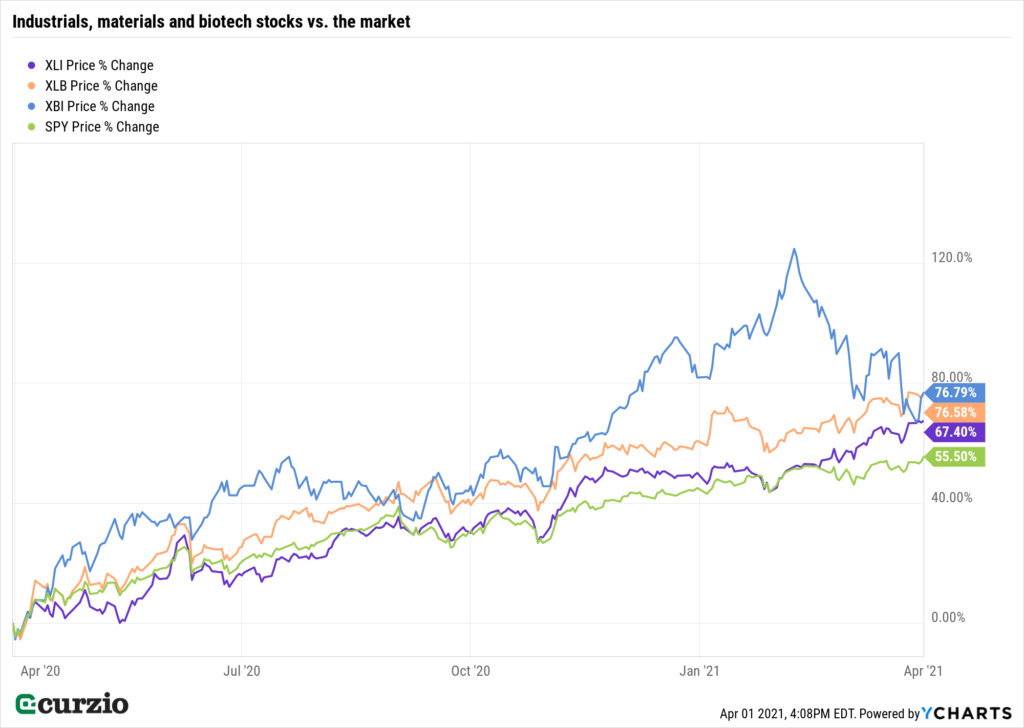

- Industrials—such as the Industrial Select Sector SPDR ETF (XLI)

Historically, industrials are among leading beneficiaries of any large infrastructure spending—as well as rising capital spending. Industrial stocks are generally the biggest beneficiary of a GDP recovery—and, therefore, would be the sector to own at this stage of the economic cycle, even if we didn’t have a massive infrastructure bill in the works.

Over the past 10 years, industrials underperformed the S&P 500 by about 40% (about 4% a year). There’s room for the sector to catch up with the market and even outperform, like this year, when it beat the market by nearly 15%.

- Materials—such as the Materials Select Sector SPDR ETF (XLB)

More fiscal spending will lead to higher inflation. Material stocks have historically been among major beneficiaries of inflationary environments—and I expect repeat performance in the “new Roaring ’20s” for the sector.

Much like the industrials, the materials have been leading the market over the past year… but lagging it over the past decade. This performance lag of about 10% a year is likely to close within the next few years.

- Biotech—such as the SPDR Biotech ETF (XBI)

Biotech can be the most rewarding—and the most frustrating—sector there is. Biotech stocks tend to start with just one idea… and then tend to lose money for years, if not decades. But if they hit it big—like Moderna (MRNA) did with its vaccine—the sky’s the limit.

This is why having some biotech is a must for a “Roaring ’20s” portfolio… but the safest way is via an exchange-traded fund (ETF)—where you own a portfolio of stocks and benefit from the successes of the entire sector without having to bet on just a couple of companies.

XBI is no slouch: Over the past decade, it rallied 510%, nearly doubling the market return. But, thanks to a 21% correction, it’s now a much better bargain than it was in early February… and it’s my third pick to play the COVID recovery.

These three sectors are among the main beneficiaries of the massive Roaring ’20s trend.

But there will be more ways to profit both on the long and the short sides of the markets as we learn more about the infrastructure plan, and as more economic news develops.

Stay tuned…

Editor’s note:

As Genia mentions, the digital money trend, like many others, has sharply accelerated post-COVID… in part because cryptos with limited supply, like bitcoin, act as a hedge against massive money printing and a falling dollar.

If you don’t own cryptos yet… don’t wait too long. We’re on the cusp of a disruption of the entire financial industry… and many more millionaires will be made.

Frank’s Crypto Intelligence portfolio has already seen five 1000%-plus winners… and if you join today, you’ll have access to a new crypto pick he believes could be the SIXTH.