Americans love stuff—and we’re running out of places to put it.

Consider a few of these statistics:

- The average American household spends $1,700 annually on clothing. And American women have 30 outfits on average, compared to 9 in 1930.

- The U.S. is home to just 3.1% of the world’s children… but more than 40% of the world’s toys.

- Americans spend $18,000 a year, on average, on nonessentials.

- Despite new homes growing, on average, 1,000 square feet over the last four decades (from about 1,500 to about 2,500), one in four Americans are unable to park in their garage due to clutter.

It’s no wonder 1 in 10 Americans outsource their self-storage needs… or that self-storage is a nearly $60 billion industry, and growing fast: By 2026, the industry is expected to grow by about 30%.

Self-storage has been a huge success because it’s so practical: For a relatively small monthly fee, you can rent a climate-controlled, theft-protected, 24/7-accessible unit to store anything from furniture to a car.

Small businesses often use self-storage facilities to store documents, equipment, and inventory. And plenty of folks need short-term storage when moving to a new house… or a new city.

For city dwellers with smaller houses or apartments, self-storage can provide valuable extra space for less cost than a larger home.

And because the self-storage business minimizes social interactions, many facilities remained open during the height of the COVID pandemic… and have maintained strong occupancy levels.

But with only about 11% of all U.S. households currently renting a self-storage unit… there’s plenty of room for the industry to expand.

And one of my favorite ways to play the trend is CubeSmart (CUBE).

Even though it’s a real estate investment trust (REIT)—which, as I explained last week, means it belongs to an interest rate-sensitive sector—this stock has significant inflation-fighting power.

Here are 4 reasons CUBE tops my list of favorite REITs right now…

No. 1: Its massive presence in most major U.S. metropolitan areas

The company’s signature cube-like self-storage buildings can be found in many places in the country—largely in densely populated cities with limited living space and high costs of housing.

These cities are prime areas for storage, where the value of extra space is high relative to the cost of living.

CUBE also manages storage facilities for smaller operators—at year-end 2021, it was managing 651 third-party facilities.

No. 2: Its operational strength, reflected in its 3.5% forward dividend yield

Make no mistake: CUBE is a fast-growing company. In 2021, it grew total revenues by 13.1% and net operating income (a major metric for REITs) by 17.2%.

This is evident in its growing dividends: last November, CUBE announced a massive 26.5% boost to its quarterly dividend—making 2022 the company’s 11th consecutive year of increased dividends.

Taking into account the new payout, CUBE now yields 3.5%… vs. the S&P’s 1.6%.

No. 3: It’s ideally suited to an inflationary market

Thanks to its month-to-month leases, CUBE can quickly adapt pricing as economic conditions change. It’s a much better inflation setup compared to its many peers in other areas of real estate where long-term leases are prevalent.

Plus, CUBE is a major player in a very fragmented self-storage market… where the top 10 operators collectively own only 24% of the market share.

It’s well-positioned to continue managing for and buying smaller operators, further expanding the business and setting itself up for higher profit and dividend growth.

And as a relatively small company with a market cap of just $11 billion, it could become an acquisition target itself… yet another reason to own it at current levels.

No. 4: The market is offering us a buying opportunity

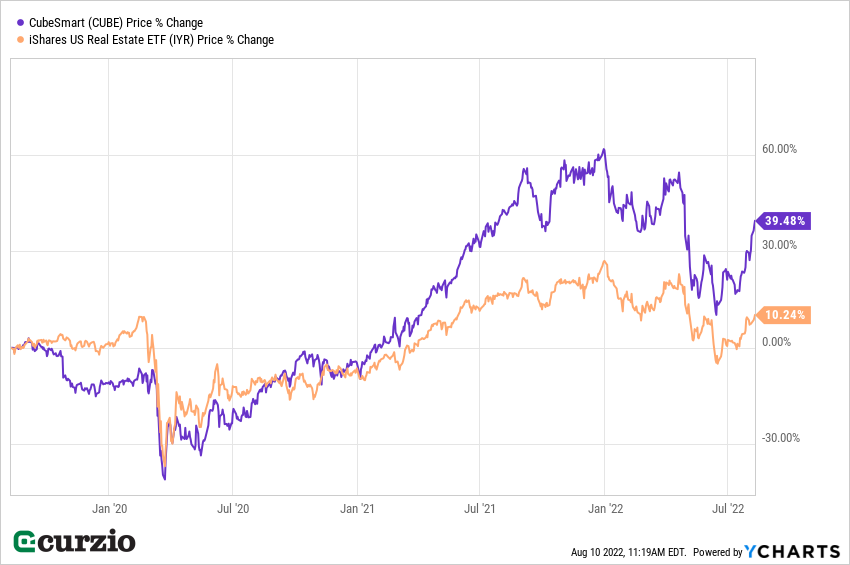

After sliding with the rest of the REIT sector (by some 32% at its lowest point of the year), CUBE has since recovered… as investors took advantage of the bargains. But it still trades some 13% lower for the year, as you can see below.

This sharp price recovery is a sign of strength… especially for a stock that outperforms its peers (represented by the iShares US Real Estate ETF IYR on the chart above).

In a rising rate environment, income investors want to play it safe… and we can do it by selecting higher-quality REITs with strong balance sheets, a steady supply of tenants, and a way to profit from inflation and temporary weaknesses among the competition.

And that’s exactly what CUBE provides.

P.S. In Unlimited Income, I recently recommended another REIT set to thrive, regardless of a recession.

This company acts as a critical link in the global supply chain… which means the recovery from the supply chain crisis will act as a massive growth driver for years.

Plus, it pays a 2.5% dividend.

Access this asset—risk-free—plus a portfolio full of my favorite dividend stocks, many of which are now trading at incredible bargains.