Dividends aren’t sexy… but they get the job done.

Through good times and bad, they’ll make you money.

Over time, they account for a large portion of stock market returns.

And dividends can also serve as an important portfolio stabilizer, picking up some of the slack during pullbacks and bear markets.

The markets remain in a historic uptrend… The S&P 500 and the Dow 30 are once again hitting new all-time highs. We’ve also seen constant volatility… thanks to inflation, China, and supply shortages.

But the right dividend payers will continue to deliver through the market’s ups and downs.

Like growth assets, not just any income asset will do. There are dividend stocks that sport a high yield… but promise no stability when conditions worsen.

Plus, a high yield can reflect a share price decline… a sign that the market doesn’t like the company or its outlook.

Choosing the best stock for all markets takes time and effort.

But I want you to stay safe.

So today, I’ll tell you three of my favorite ways to invest for income with minimal effort… and maximum safety.

Remember, there are only a few reasons a company would pay some of its cash to shareholders through a dividend.

For one, a dividend signals to the market (and to competitors) that life is good… that it’s creating more cash than it can use to support or expand the existing business.

Dividends also indicate that the company has committed to a shareholder payout policy. Even after the 2020 bear market, when some companies had to suspend dividends, most restored them as soon as possible.

And dividend companies are typically safer. Their business has matured enough to generate cash… and company management has to be disciplined and follow the established dividend policies.

Finally, companies don’t want to accumulate more cash than they absolutely need: Having excess cash on the balance sheet can make them an acquisition target—not an ideal scenario for managers who want to keep their jobs. The more money this type of company makes, the faster it will increase the size of the payout.

The best income stocks have growing and reliable dividends. The share price of these companies will also rise as more and more investors realize the stability of the business… and the growth potential of its dividends.

Better yet, most investors own dividend stocks for income, so these stocks are more likely to hold their value during a selloff… when their dividends truly shine.

I’ve dubbed these companies leveraged income assets (LIAs). In sum, these are assets that generate income and capital gains.

The best way to own them is to keep reinvesting the payouts… and to diversify with many—not just one or two.

The great news: The three exchange-traded funds (ETFs) below do the stock picking and the diversification for you.

They also have rock-bottom fees, and the smaller the fee, the more of the dividends you get to keep.

All you need to do is to pick one or two of these funds to put your income portfolio on autopilot…

Vanguard Dividend Appreciation ETF (VIG)

VIG is one of the many funds that choose holdings based on a history of dividend growth.

The logic is simple: a stable dividend payer is more likely to retain this stability… and keep rewarding investors.

VIG requires stocks to have a minimum of 10 years of consecutive dividend growth.

Additional criteria, some of which are proprietary, ensure this growth is sustainable… and eliminates about a quarter of all stocks with above-average dividends (often an early sign of trouble).

As the fund’s $63 billion under management proves, this strategy works.

But it’s not perfect…

For one, VIG only yields some 1.6%… and its collection of stocks isn’t cheap, with an expected price-to-earnings (P/E) ratio of 20.7.

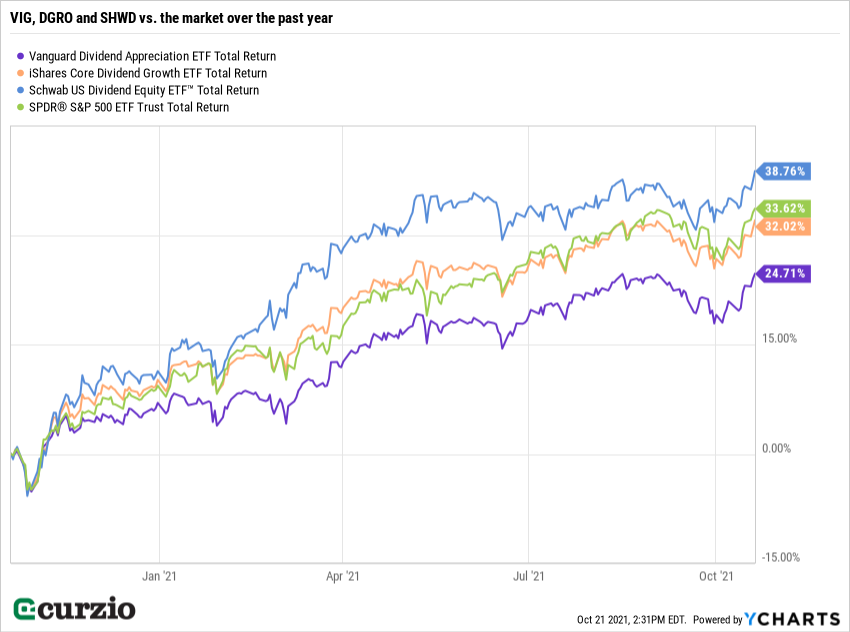

For another, over the past year VIG underperformed the market.

That’s because VIG’s focus on quality and dividend history meant it held no energy stocks this year… just as the sector started to outperform everything else in the market.

But this also makes VIG safer than your average value fund…

Its strategy has been time-tested through several bull and bear markets… That’s because it follows on the heels of another popular Vanguard fund—the Vanguard Dividend Growth (VDIGX), a $51 billion mutual fund that’s been around since 1992.

In sum, VIG has a history of strong performance, thanks to a great theoretical and practical foundation… and the annual fee is only 0.06%.

iShares Core Dividend Growth ETF (DGRO)

Slightly more expensive (at 0.08%), DGRO also focuses its efforts on dividend growth. It doesn’t cut the highest yielders… and as a result, DGRO’s yields 2%—higher than VIG.

DGRO is also much more diversified… with as many as 389 stocks at the last count (vs. VIG’s 247).

More importantly, in the past year DGRO outperformed VIG—and just marginally underperformed the market… even though its stock selection process also shut out the energy sector almost completely this year.

A larger-than-average tech allocation (18% vs. VIG’s 15% and 12% for the average peer) is one of the reasons. Microsoft (MSFT), the largest DGRO holding, is up 40% year to date alone.

It’s a great fund, and it well deserves to be on an income investor’s radar.

Schwab U.S. Dividend Equity ETF (SCHD)

Similar to VIG, SCHD also uses a stock screen… and bases its selection on dividend history. Additional criteria include dividend yield, free cash flow, debt, return on equity, and dividend growth rate over the past five years.

Out of the three ETFs, SCHD has the strictest criteria… and as a result, a much smaller portfolio of only 100 stocks.

But this portfolio yields as much as 2.9%… and its components are cheap—trading at a projected P/E ratio of just 14.1.

It’s been the best fund to own over the past year.

As you can see on the chart below, SCHD even beat the market… not to mention both VIG and DGRO.

This year, SCHD held fewer health care and utilities stocks than its peers… which helped it to outperform.

And I really like the fact that its stock selection process focuses on the highest-yielding 100 stocks in the market… while not ignoring such quality metrics as cash flow to total debt and return on equity. SCHD has more of a value bend than VIG or DGRO… and its payout is therefore higher. If your portfolio already has too many value stocks, you might be better off with the other two ETFs I profiled today.

Longer-term, all three funds are winners… You can’t go wrong with either (or all three), especially if you’re looking for an ETF for the buy-and-forget portion of your portfolio.

Editor’s note:

In Genia’s Unlimited Income advisory, you’ll find a portfolio full of “LIAs”—stocks that have not only delivered consistent dividend payments… but capital gains as high as 104%.

Join here for immediate access to the entire portfolio… and a free report on the top income stocks to buy—and avoid—TODAY.