Last week, I told you why a recession is unavoidable.

And the market is finally getting the message…

The S&P 500 has given back almost all of its 2023 gains. And the selloff accelerated last week as the Fed’s fight against inflation has broken the entire regional banking sector.

A few days ago, Silicon Valley Bank (SVB) was seized by regulators. By Monday morning, Signature Bank (SBNY) became the next casualty. The government is rushing in to contain the damage… but stocks across the sector—from First Republic (FRC) to KeyCorp (KEY)—are down sharply.

SVB and SBNY are the second- and third-largest failed banks in U.S. history.

In short, the financial sector—the backbone of the economy—is crashing…

And regional banks won’t be the last victims of the Fed’s rate hikes.

The turmoil creates an incredibly dangerous market in the near term—as market declines go hand in hand with economic troubles.

And it typically takes the market a long time to recover from these kinds of shocks.

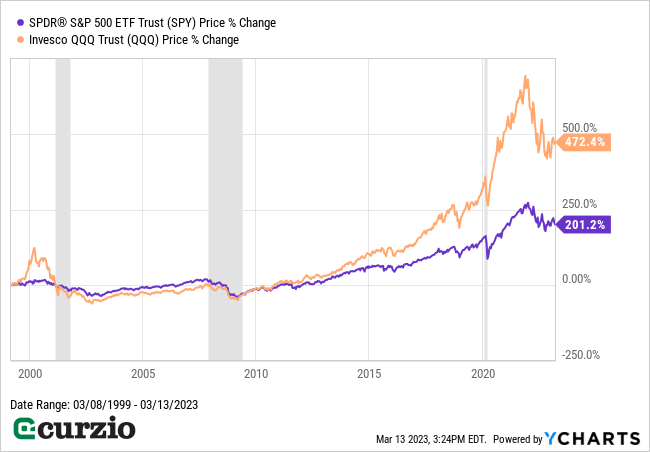

For example, after the dot-com bubble popped, the S&P 500 (represented by the purple line on the chart below) took seven years to return to its March 2000 highs.

And it was much worse for the ”bubbliest” index of the dot-com era—the tech-heavy Nasdaq 100 (the orange line)—which didn’t conquer its 2000 highs until late 2014.

In other words, if you bought the Nasdaq 100 ETF in March 2000, you didn’t break even until the end of 2014—nearly 15 years (and two recessions) later.

In short, investors need to use extreme caution in this market to avoid suffering in the long term.

Today, I’ll highlight the corners of the market investors should avoid at all costs…

1. Homebuilders and other housing companies

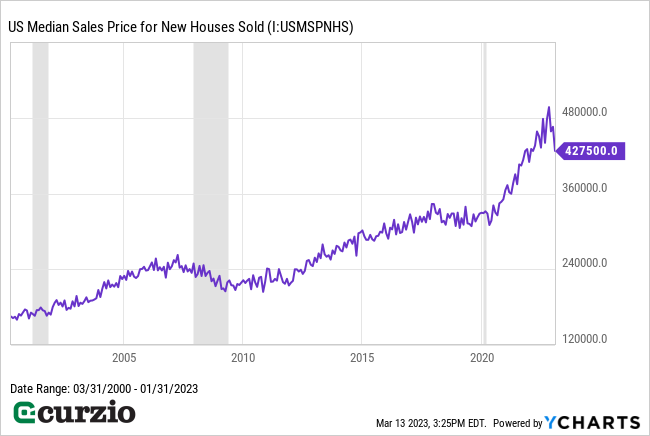

The housing market seemed unstoppable just two years ago.

Boosted by rock-bottom mortgage rates, COVID-related migration from big cities, and institutional buying… real estate prices skyrocketed following the pandemic.

But as inflation and interest rates started to rise, the bubble in the housing market—the most interest-rate sensitive area of the economy—was bound to pop.

A clear sign of the top was when the real estate data firm Zillow shut down its homebuying business at the end of 2021… after racking up $420 million in losses in just three months.

By the time Zillow called it quits, mortgage rates had already risen from their December 2020 low of 2.66% to 3.1%. But the real damage from higher rates was only beginning.

Today, mortgage rates have surged more than 150% from their 2020 lows… freezing home buying and pushing real estate prices off a cliff.

The median sales price for new houses is down 14% from its all-time highs set last October… the sharpest four-month price decline on record.

You can also see the effects of rising rates on home-buying activity. Pending home sales are down 24% in just a year.

In short, the entire housing sector is already in a recession.

And the current blowup in regional banks creates another major headwind for housing, since smaller banks are typically a big source of mortgage lending.

Put simply, housing-related stocks (including homebuilders, appliance makers, home improvement stores, etc.) are set for a big decline.

Prudent investors should avoid any stocks related to the real estate market.

2. Small caps

Small-cap stocks are another area ripe for declines…

For one, smaller companies are much more vulnerable to a recession than larger caps. They’re not as financially stable—and often have to borrow money at higher rates than their larger competitors.

Smaller businesses also have less room for mistakes. They can run into trouble if even one of their suppliers or customers goes out of business.

Plus, these companies typically have less pricing power than large-cap companies, which leads to lower profit margins (and declining earnings) during a recession.

Lastly, small caps tend to be much more volatile than the overall market. Their selloffs can be dramatic.

For example, when COVID slammed the market in March 2020, the Russell 2000 plunged 41% at its worst point, vs. a 34% drop for the S&P 500. And for the first quarter (Q1) of 2020, the Russell fell 32.5%, compared to a 23.8% decline for the S&P 500. In fact, the COVID selloff was the small-cap index’s fourth decline of 20% or more in just 10 years.

More recently, small caps have plunged more than 12% from their February 2023 highs… much worse than the market’s 7% decline.

Don’t get me wrong: Small-cap stocks are great to own during a bull market. And they can quickly turn into multibaggers when the economy is strong…

But, as a group, they tend to underperform when the economy hits a rough patch.

That’s why you need to be extra careful with small caps in a recessionary market—especially unprofitable ones…

3. Unprofitable tech

It’s no secret that young, unprofitable tech and biotech companies are among the riskiest stocks in the market. They’ve always been prone to huge booms and busts that take years to play out.

There’s no shortage of examples throughout market history—and the story always plays out the same: Those who pay high prices for risky assets usually end up suffering massive losses.

Back in 1999, the rise of the internet caused a boom in the shares of companies like Pets.com, Boo.com, and CDNow. But there was little substance to their hyped-up business models. And once the boom turned into a bust, their investors wound up with nothing.

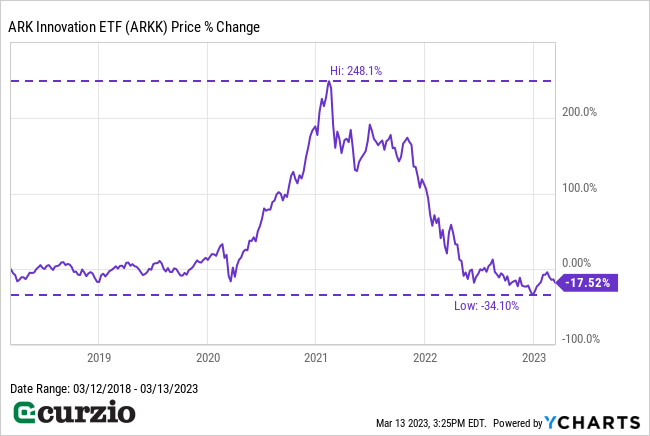

The perfect example of these kinds of stocks in today’s market is Cathie Wood’s popular ARK Innovation ETF (ARKK).

This actively managed thematic fund invests mostly in smaller-cap “disruptive innovation” companies like Zoom (ZM), Roku (ROKU), Teladoc (TDOC) and CRISPR Therapeutics (CRSP).

The fund’s investing philosophy can be summed up as “growth at any cost.” That model worked great during the post-COVID “free money” era of 2020, as you can see below…

But the fund quickly turned south in early 2021, when inflation started to accelerate… and the market started to anticipate the Fed’s restrictive money policies.

As of now, the fund is down more than 70% off its highs.

And because the majority of the companies in ARKK have yet to make profit… and need ultra-low interest rates to support their cash-burning businesses, they will continue to underperform the market during times of economic stress.

In sum, as inflation continues its rampage and interest rates remain high… investors should avoid housing-related stocks, small caps, and “growth at any cost” names. These areas will face massive, ongoing pressures as we head into a recession.

Despite the gloomy outlook, there are always ways to generate profits… even in a treacherous market. Next week, I’ll tell you the best ways to play a recessionary environment—so stay tuned.

P.S. Investors need to be more cautious than ever.

And Moneyflow Trader the perfect strategy to protect your long positions and make a fortune as a recession drags down the market.