If you casually glanced at Walmart’s (WMT) latest stock movements, you might be startled by the price action.

On Friday, WMT closed at $175.56… and today, it opened some 66% lower, at just $59.

But don’t worry, nothing bad happened.

In fact, quite the opposite… And the market was well aware of the pending change.

You see, the drop in share price was the result of a 3:1 stock split, which went into effect today (February 26).

Put simply, the split tripled the number of Walmart’s shares outstanding… which reduced the value of each share by 2/3.

So, if you owned 100 shares of Walmart on Friday, you’re now the proud owner of 300 shares. But it’s important to note that the total value of your position is unchanged.

That’s because a stock split does nothing to the stock’s fundamentals, its outlook, or the size of your position.

So what’s the point? Why does a company split its shares if nothing really changes?

Simple…

Why stocks split

Traditionally, stock splits are a way to make a stock more attractive to smaller investors… by making it more affordable to buy a “round lot” of shares (multiples of 100).

And because the market isn’t always 100% rational, there’s some psychology involved, too: The stock looks cheaper purely because its “price tag” is now lower.

From a valuation perspective, the company will have the same price-to-earnings (P/E), market cap (the total value of the company), and other metrics after the split.

In other words, a stock split does nothing to change the stock’s story.

That means that by itself, a split isn’t a bullish indicator. A stock’s long-term performance depends on whether the company can grow profits (or keep paying dividends)… not the “sticker price” of its shares.

However, many splits are treated by the market as good news… with stocks receiving an additional boost simply because of that change in perception.

One reason: When a stock splits, it’s usually after a period of strong performance… which may have pushed the shares too high for smaller investors.

In such cases, splits can open up the stock to a pool of new investors… and create additional positive momentum for the company.

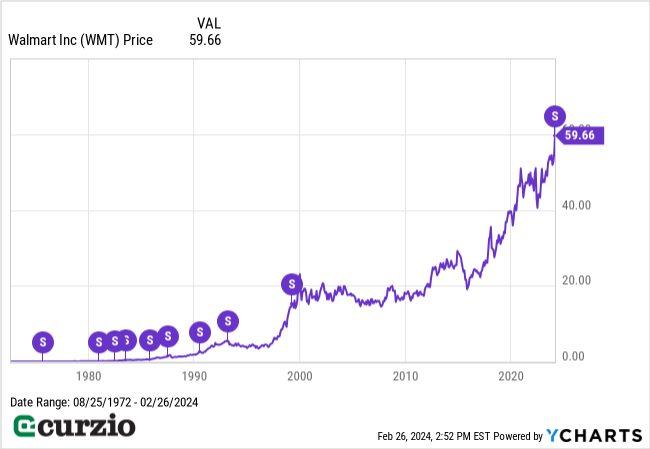

That’s likely to be the case with Walmart. As you can see from the chart below, the stock has recently found its strength after marching in place for almost two decades.

And the market is likely to see the stock split as yet more confirmation that Walmart is on the right track… and that the stock remains an attractive buy at current levels.

Of course, a stock split alone isn’t enough to make a stock a buy… Like I said, a split doesn’t change a stock’s underlying fundamentals.

But Walmart has several other tailwinds that will continue to drive its long-term performance. Here are 3 of the biggest factors that make it an extremely attractive stock…

3 reasons this retailer should be on your shopping list

1. It’s a secret tech titan

When you think of Walmart, you probably think of its massive superstores, its nearly ubiquitous presence across the U.S., or its low prices on everything from groceries to apparel to sporting goods.

You might not think of Walmart as a leader in technological innovation…

But you should.

The world’s largest retailer has been a tech pioneer since its early days.

In 1975, for example, Walmart was one of the first businesses to install electronic cash registers… AND use an IBM computer system to track and control inventory.

In 1988, Walmart launched its private satellite network, connecting all its stores, speeding up checkouts, improving data communication, and accelerating credit card processing.

In 1996, its internet-based RetailLink system connected vendors to critical information on sales trends and inventory levels.

And it hasn’t slowed down.

Just last week, it announced the $2.3 billion acquisition of a smart TV maker VIZIO Holdings (VZIO)… part of Walmart’s aggressive move into advertising.

2. The world’s biggest retailer is still growing

Walmart’s revenue growth continues to benefit from its low-price focus—which has become especially important in today’s high inflation world, as consumers look to stretch their shopping budgets.

In the fourth quarter (Q4) of 2024, Walmart’s sales reached $173.4 billion—up 5.7% year over year. And its earnings per share (EPS) reached $1.80 (vs. the $1.64 analysts expected).

No wonder WMT is up 13% in 2024 vs. the market’s 6.5%.

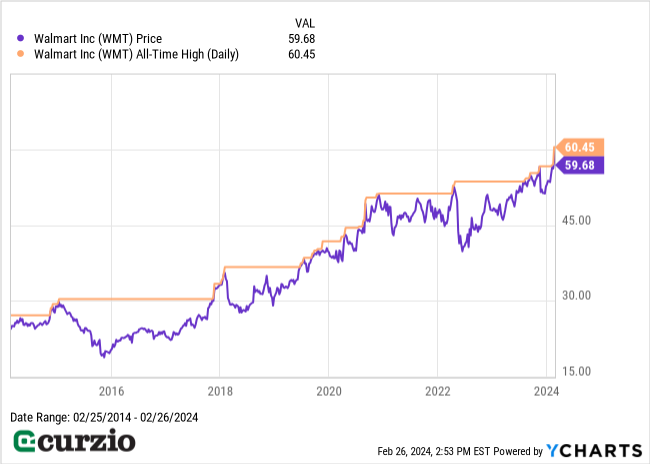

In fact, the stock is trading near all-time highs (adjusted for its split), as the chart above shows.

3. It’s a better bargain than its peers

Despite its impressive performance, Walmart is still much cheaper than the competition: WMT trades at about 24.5 times (24.5x) expected earnings vs. 41.7x for Amazon (AMZN) and 47x for Costco (COST).

Not to mention, it pays a higher dividend: Walmart’s was hiked by 9% last week to a 1.4% yield… while Amazon pays nothing and Costco pays under 1%.

Conclusion

Walmart is already the world’s largest retailer… and trading near all-time highs—but it has way more room to run, thanks to several long-term tailwinds. Better yet, its recent stock split opens up an additional pool of investors, which will create even more positive momentum.

Put simply, at current levels, Walmart’s stock is as good a bargain as you’d find on its store shelves.