40 million people.

This is how many Chinese citizens were under quarantine measures last Friday as their cities went on lockdown due to the coronavirus scare.

The latest highly contagious coronavirus (CDC 2019-nCoV) has already claimed the lives of 81 people.

China has 1.4 billion people. But 40 million is enough to populate a mid-sized country. In fact, there are only 35 countries in the world with a total population of 40 million or more. Imagine one of them being closed off from the outside world!

To contain the virus, the country has also called off all Lunar New Year celebrations, closed off movie theaters and theme parks, and extended business and office closures until February 2. Hong Kong closed its schools until February 17.

These measures are unprecedented.

But if they don’t work and the coronavirus continues to spread, it could cause real panic… and an even economic downturn.

The quarantine alone is a massive undertaking that could have widespread consequences… including derailing certain market sectors.

When an event of this magnitude occurs, it’s important to stay alert to the companies at risk… and those that stand to benefit…

Over the last few days, the prospects of some sectors have become more uncertain.

For example, major cruise companies and airlines.

Last week alone (January 21–24), Royal Caribbean Cruises (RCL) dropped 6.3%, Carnival (CCL) is down 8.4%, and United Continental (UAL) lost 8.7%. Not to mention the shares of China’s travel service company Trip.com Ltd (TCOM), which was down 18%. And that’s not counting today’s declines.

Compare these sharp drops to the S&P’s 1% decline.

International—especially leisure—travel is often the first victim of any health-related panic. The market knows it, and the coronavirus is no exception.

The declines mentioned above, and many others, shouldn’t come as a surprise if you consider the Chinese government’s travel ban. These sectors are likely to take a larger hit as we watch the story develop. Until we get more clarity on the virus, travel-related stocks are a risky bet and best avoided.

Some major consumer stocks have also suffered over the past week… especially companies with significant exposure to China.

As of Friday, Yum! China Holdings (YUMC) is down 11.2% (while its U.S.-focused parent Yum! Brands (YUM) was flat). Luckin Coffee (LK), China’s answer to Starbucks, is down 18%.

Entertainment stocks have also suffered. Imax Corp. (IMAX), a movie technology company, lost 12% in just four days, while Disney (DIS) was down some 3%.

Some of you may be wondering if these declines present an opportunity to buy…

While the stocks I’ve mentioned should bounce back if the efforts to contain the coronavirus are successful… it’s impossible to say if the efforts will be, or how long they’ll take to work.

Moreover, the virus has already spread to 14 countries, adding to the uncertainty. The U.S. alone has five confirmed cases.

The recent declines could continue…

Plus, the S&P 500 is already expensive, trading at record highs. Virus-related concerns could cause many investors to start booking their gains en masse.

Still, while there’s good reason to be cautious, it’s worth noting that 17 years ago, during another viral outbreak in China—SARS (severe acute respiratory syndrome)—the S&P 500 shook off the dangers and rallied.

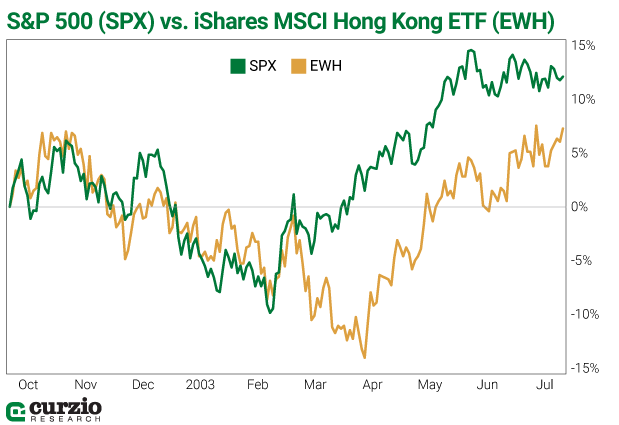

Between November 2002 and July 2003, when there were more than 8,000 cases of SARS and 774 deaths, the S&P 500 was up 11.8%.

Even Hong Kong shares (represented by the iShares MSCI Hong Kong ETF [EWH] in the chart below), rebounded from the initial 13.7% decline and ended more than 7% higher.

Much like the latest coronavirus, SARS spreads from animals to humans.

Unless the outbreak turns out to be much worse than the SARS case (which is a possibility, given how much more globally entwined the Chinese economy is today vs. 2002, and the fact that the coronavirus is contagious during the incubation period), the market as a whole should be able to withstand the risks.

Over the past few days, a few companies have emerged that could actually benefit from the worst-case scenario.

The most interesting of these is U.S. biotech Moderna (MRNA).

A standout IPO from 2018 (it has the distinction of being the largest IPO in the history of biotech companies), Moderna is already working on the vaccine against the 2019-nCoV coronavirus.

Remember: One reason for the worldwide concern is that there’s still no vaccination or cure for the coronavirus. While many researchers are working on a solution, Moderna might already have a leg up on several other biotechs.

Its vaccines are based on a molecule called “messenger RNA” (or mRNA)—a molecule with the potential to induce the human body to make its own medicine. And the company already has respiratory syndromes and flu vaccines in its pipeline.

Just last Thursday (January 23), Moderna said it’s collaborating with the Coalition for Epidemic Preparedness Innovations (CEPI) on a vaccine for the coronavirus. It’s even receiving a grant for the work. If this vaccine is a success, MRNA will clearly benefit.

Plus, the company presents a very interesting long-term biotech story; in addition to antiviral medicines, its mRNA approach has the potential to create a vaccine against cancer.

Just be aware that Moderna, like so many of its biotech peers, is unprofitable—its future depends on the ultimate success of its innovative approach.

China’s unprecedented quarantine of 40 million people, together with the worldwide attention the coronavirus has received, gives us a reason to be optimistic about the outlook for the market. But with stocks trading near record highs, we have good reason to exercise caution, too.

Stay alert to the new risks… and opportunities. It will pay off in the long term.

Editor’s note: Want more stock picks from industry insiders like Genia? The Dollar Stock Club is hands-down the easiest way to discover new ideas… stay diversified… and find income. Every Thursday, you could be getting a new, thoroughly vetted stock pick delivered straight to your inbox. For only $1.

Learn more about The Dollar Stock Club—and don’t miss this Thursday’s pick!