It’s no secret that today’s economic landscape bears a striking resemblance to the turbulent 1970s—the era of “stagflation.”

It has all the hallmarks…

Struggling equities.

Slow growth.

High inflation.

Raging energy prices.

And an interest-rate hiking cycle.

No wonder investors are fearful—and sold both stocks and bonds this year.

It’s incredibly rare for stocks and bonds to decline together… Throughout the 1970s, it happened only twice, in 1973 and 1974.

Typically, stocks and bonds move in opposite directions—which means bonds are generally considered a safe asset in a market selloff.

But owning bonds hasn’t helped during the worst of 2022 (something I predicted back in March).

The combination of fast-rising interest rates and stubbornly high inflation is deadly for bonds: Rising rates push bond prices down… while raging inflation erodes the purchasing power of both the principal and its annual interest payment, or “coupon.”

Once inflation is under control and the Fed quits its rate-hiking path, bonds will eventually become enticing again. But for now, they’re simply too risky compared to their return potential.

This raises an important question—especially for retirees and safety-oriented investors: If you can’t hide in bonds… is there anywhere you can hide?

Yes—in “defensive” market sectors with low economic sensitivity and market-beating dividends.

3 defensive sectors and 3 easy ways to get exposure

Utilities, consumer staples, and healthcare assets tend to do much better than the market in recessions because their services are necessary, regardless of the economy.

The Utilities Select Sector ETF (XLU), the leading exchange-traded fund (ETF) in the sector, holds utilities big and small… like NextEra Energy (NEE), Southern (SO), Duke Energy (DUK), and American Water Works (AWK). XLU yields 2.6% vs. the market’s 1.7%.

The Consumer Staples Select Sector ETF (XLP) is a one-stop investment with exposure to leading consumer companies… from Procter & Gamble (PG) to Coca-Cola (KO) and PepsiCo (PEP). It also owns retailers like Costco (COST), Walmart (WMT), and Estee Lauder (EL)… tobacco companies Altria (MO) and Philip Morris (PM)… and food companies like Mondelez (MDLZ) and Archer-Daniels Midland (ADM). XLP yields 2.5%.

The Health Care Select Sector ETF (XLV) owns health insurers like UnitedHealth Group (UNH)… Big Pharma companies like Johnson & Johnson (JNJ) and Pfizer (PFE)… biotechs like Amgen (AMGN)… and equipment makers like Thermo Fisher (TMO) and Danaher (DHR).

Because it holds several discretionary businesses, it’s the least defensive of today’s three funds… XLV yields the least: 1.5%.

But it still has the potential to outperform the market when times get tough, thanks to the financial strength of its holdings and our ever-important healthcare needs.

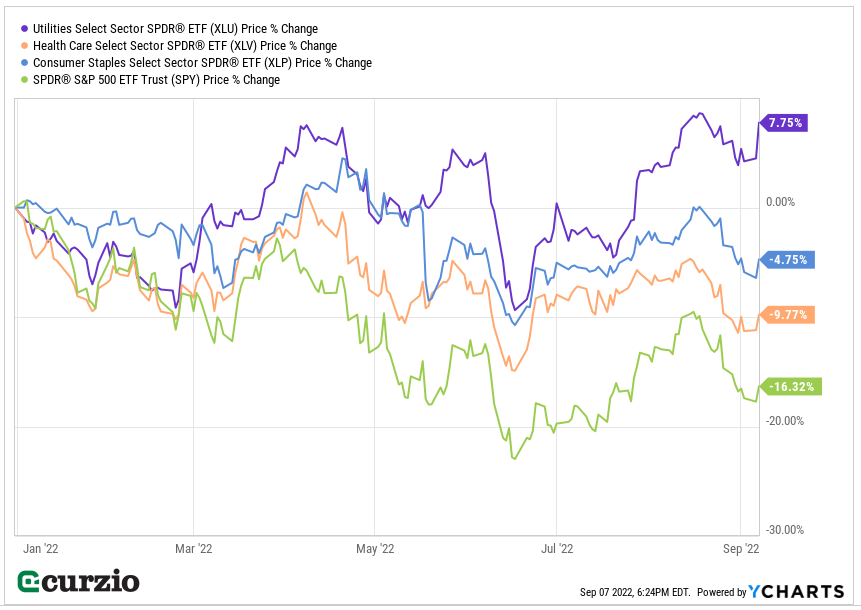

Below, I plotted the year-to-date performance of all three ETFs vs. the market.

As you can see, utilities stand out the most: XLU is up 7.6% so far this year (not counting dividends), while the market has lost 15.7%.

While down for the year, XLP and XLV have also outperformed the market by a significant margin.

If you’d like access to a portfolio full of inflation-busting ideas that return steady income, I highly recommend my Unlimited Income advisory. On Tuesday, members received my latest recommendation… a stock that’s a perfect fit for this economy. It has a unique business model and offers one of the highest dividend yields in the S&P 500.

And take note of the three ETFs above. They’ll help keep your investments safe from the ravages of inflation and a slow-growth economy… without excessive risk.