Every year, investors wait with bated breath—like kids waiting for Santa Claus—in anticipation of Wall Street legend Byron Wien’s annual list of 10 surprises for the upcoming market year.

The current vice-chair of Blackstone’s wealth business, Wien has been publishing this list for 36 years…

Last January, I highlighted my take on the list, selecting the three most important “surprises” to expect in 2022. In a couple of weeks, Wien—now joined by Joe Zidle—will reveal the 2023 list. I’ll give you my reaction as soon as it’s published.

For now, let’s look at whether the surprises I discussed last year came to fruition… and what they mean for your portfolio going into 2023.

Value stocks

Last year, Wien predicted that the S&P 500 would make no progress in 2022… Instead, it would see a nearly 20% correction—with the value sector (the cheaper half of the market) outperforming the growth sector (the expensive half).

We here at Curzio also anticipated a much weaker market in 2022… and that value stocks (including energy) would buck the selloff.

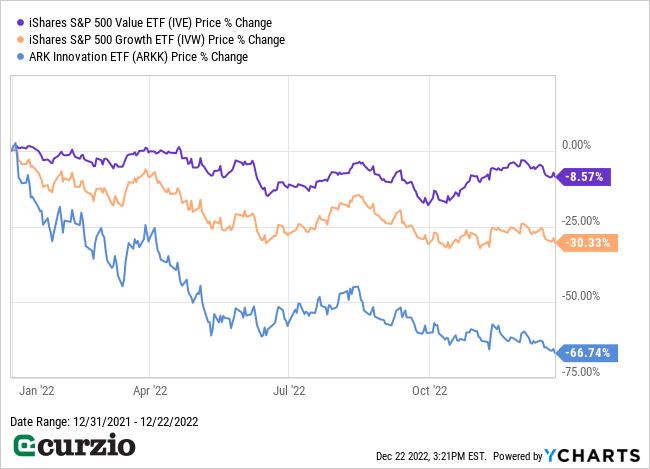

We (and Wien) were right on the money, as you can see on the chart below…

While value stocks (represented on the chart above by the iShares S&P 500 Value ETF IVE) are down 9.4% for the year… they’re holding up far better than growth stocks (illustrated by the iShares S&P 500 Growth ETF IVW), which are down 31% in 2022.

In other words, value outperformed growth by more than 20%. And the spread is even bigger when you include dividends.

Expensive stocks are a bad choice in a weaker economy or recession… especially money-losing companies years away from sustained profits—like many in the ARK Innovation ETF (ARKK), which lost more than 2/3 of its value this year (as you can see in the chart above).

But even companies with healthy, profitable businesses can be highly vulnerable to slowing economic growth…

For investors to pay more than the market average for a unit of sales or profits, they need to be confident a company is growing faster than the overall market. During a recession, they’re bound to feel less certain about an industry’s growth prospects… which leads to lower valuations (even if actual revenues and profits stay on track). And if profits end up disappointing investors… share prices will fall even further.

On the other hand, companies with moderate growth and mature businesses (which typically end up in the cheaper “value” half of the market) are more attractive in a slow economy.

For one, their dividends literally pay investors to stick around in bad times (and good)…

Plus, with “value” stocks, investors pay less per unit of profit—and these cheap valuations increasingly come into play in a scary market.

For 2023, I remain wary about overly expensive stocks as a group… but the best of the value sector—especially stocks that can pay growing dividends—will do well.

For my favorite dividend-paying stocks for this market, join us at Unlimited Income. The stocks in our portfolio outperformed the market by more than 20% this year—and I expect them to continue outperforming in 2023.

Inflation

While central bankers were claiming inflation would be transitory, Wien’s 2022 list predicted it would stay elevated at 4.5%.

All said, the average Consumer Price Index (CPI) number for 2022 was 8.1%—almost twice what Wien called for in his list. Of course, even Wien couldn’t have predicted the Russian invasion of Ukraine, which triggered a full-blown energy crisis and added to our inflation woes (and will continue to do so in 2023).

Regardless, I’ll give Wien partial credit for predicting that inflation would remain a major problem in 2022.

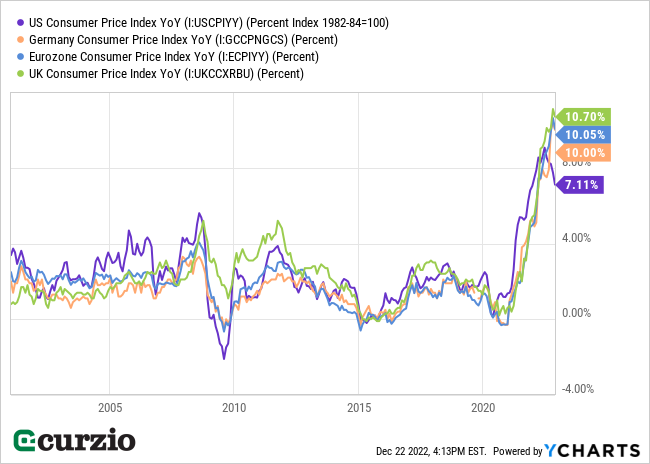

The Fed didn’t acknowledge inflation as a persistent issue until its March 2022 meeting. By that time, it was already getting out of control across the globe—as you can see below.

Since then, the U.S. Federal Reserve and other central bankers have tried to tamp down rising prices through interest rate hikes and other monetary tightening.

Whether inflation remains a problem in 2023 remains to be seen, but one thing is for certain: The era of zero interest rates is over.

Precious metals

Byron Wien’s prediction for gold in 2022 wasn’t perfect.

He said the gold prices would rally “by 20% to a new record high.”

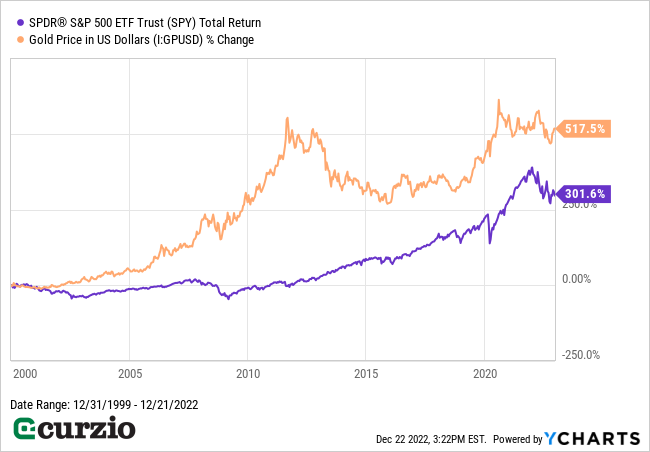

As you can see on the chart below, this hasn’t happened: Gold lost 3% year-to-date (YTD).

Still, gold fared much better than stocks, considering the S&P 500 lost about 20% this year.

And if you owned silver, you fared even better: Silver prices rallied 31% since September, and are on track to finish flat for the year.

In short, precious metals proved their safe haven status in 2022.

And as you can see from the chart below, gold has easily outperformed stocks this century. The price of gold is up about 518% since the start of 2000—far ahead of the 300% gain for the S&P 500 over the same time frame.

Precious metals should continue to shine in 2023, especially considering their historic inflation-fighting power. And I expect them to get an additional boost as “big money” institutional investors add to their gold and silver holdings for diversification purposes (since stocks and bonds have been closely correlated in 2022).

In sum, the three most important “surprises” I highlighted from Byron Wien’s 2022 list turned out to be quite accurate…

And while they’re no longer surprising, these are longer-term trends that will continue in 2023… which means you should stay focused on assets that perform well amid inflation and higher interest rates, such as dividend-paying value stocks, precious metals, and other commodities.

Your portfolio will thank you.