Everyone is talking about January’s stock market rally—and whether it’s a sign of better things to come or (as we here at Curzio believe) a temporary reprieve…

But no one seems to be paying attention to another critical rally that happened last month…

I’m talking about gold.

The precious metal jumped 5.7% last month… on par with the S&P 500’s 6.3% gain.

And over the past year, gold prices are up 6%—easily beating the S&P 500, which is down about 7%.

Gold’s strong performance shouldn’t come as a huge surprise—after all, it’s the quintessential “safe haven” asset, known for its stability during times of economic uncertainty.

So it makes sense that investors flooded into gold during the bear market of 2022.

Our Unlimited Income portfolio has already benefited from the rally… Our two precious metal positions are up about 10% and 20%.

And as inflation and economic uncertainty linger into 2023, the stage is set for gold to deliver even bigger gains over the coming months…

Here are 3 tailwinds set to push gold prices higher…

1. High inflation isn’t going away

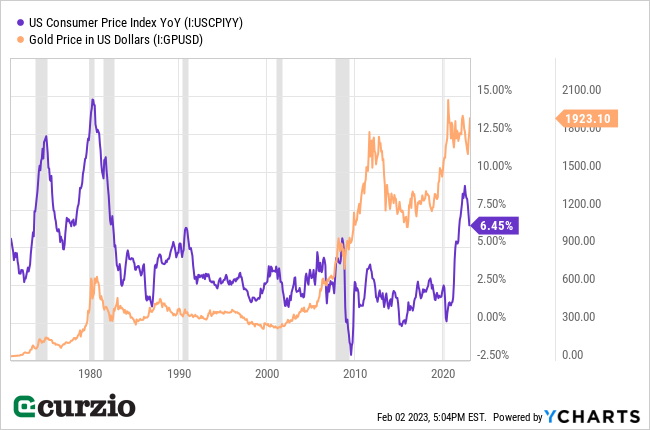

While inflation may finally be moderating… it’s still going strong: The latest Consumer Price Index (CPI) reading of 6.5% puts today’s environment on par with the inflationary 1970s and early 1980s, as you can see from the chart below.

If you were around back then, you might remember that government spending and oil prices were at similarly high levels compared to today.

As the chart above shows, gold typically gets a boost from both inflationary periods and recessions (the gray shaded areas on the chart), thanks to its “safe haven” qualities.

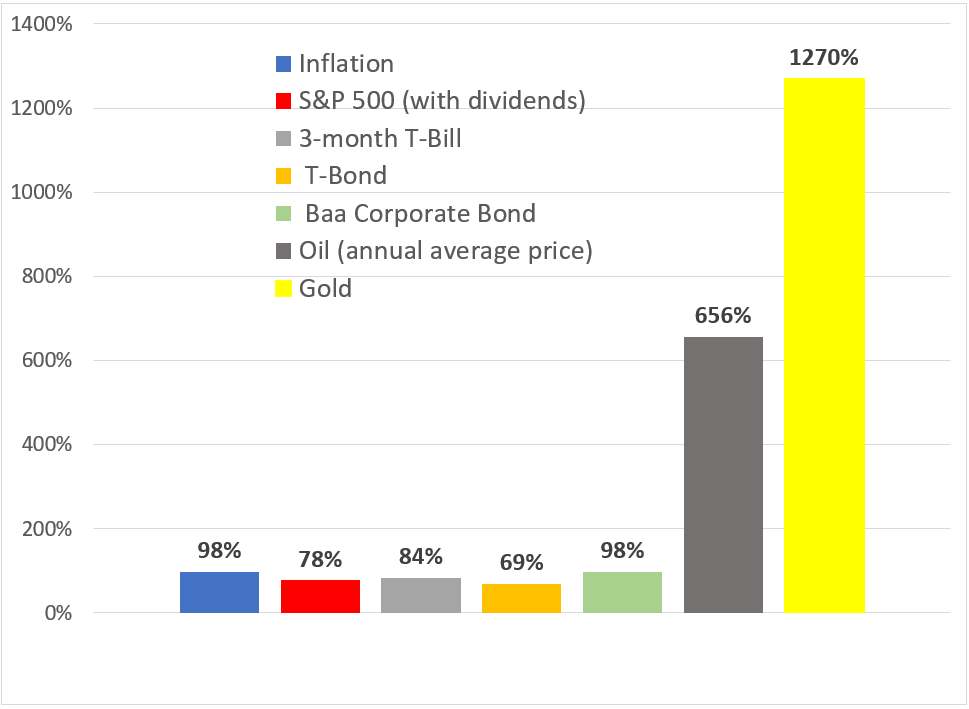

And gold was the star of the 1970s, outperforming every other major asset class.

How different assets performed in the 1970s

As we grapple with 40-year-high inflation and a likely recession in 2023… it’s a safe bet that the yellow metal will continue to act as a safe haven—and move higher from here.

2. The Federal Reserve’s balance sheet isn’t shrinking fast enough

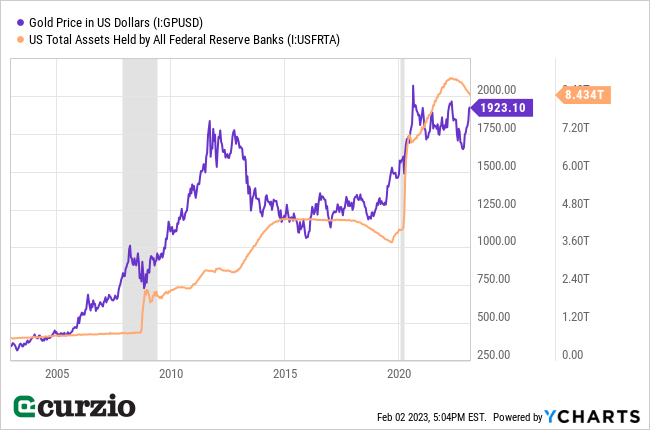

Over the past 20 years, the price of gold has had a strong correlation to the Fed’s balance sheet, as you can see on the chart below…

Simply put, the more liquidity the Fed creates, the higher gold prices go.

So it’s no wonder that gold’s value has risen more than fivefold over the past two decades.

And even though the Fed has been unwinding its balance sheet (taking some of the extra liquidity away from the market), this process has been extremely slow. Since its peak last spring, the Fed’s balance sheet has fallen by 5.5%… but it’s still 90% above the previous peak.

In short, the Fed’s bloated balance sheet will support the price of gold in 2023.

3. International demand is pushing up gold prices

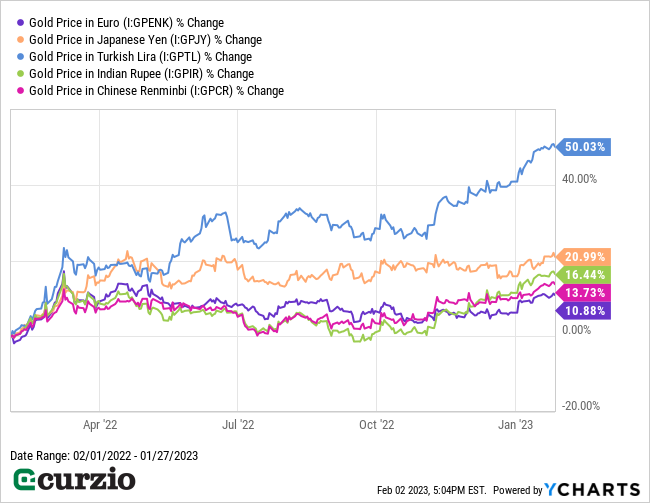

While gold delivered solid gains for U.S. investors last year, it was nothing compared to how strong gold prices have been in other countries.

In the U.S., gold is up about 6% over the past year. But in places like Turkey, gold prices surged a whopping 50% over the past year when measured in the local currency.

Below, you can see that gold’s uptrend is much stronger than the average American investor might realize. In places like China, Europe, India, and Japan… gold’s performance is well above its U.S. dollar-based 6% gain over the last 12 months. (This is, in part, because most foreign currencies underperformed the U.S. dollar in 2022.)

This international demand, fueled by local inflation and geopolitical concerns, is set to remain strong… creating another tailwind for gold prices in 2023.

How to play gold’s upside

One of the easiest ways to ride the uptrend in gold is by investing in a gold-centric exchange-traded fund (ETF).

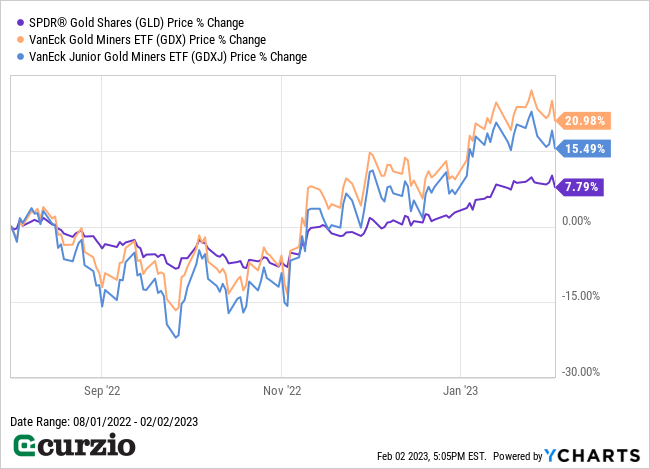

One popular choice is the SPDR Gold Shares ETF (GLD). The oldest ETF of its kind, it tracks the price of gold… and lets investors avoid the hassles and expenses (the cost of storage, insurance, and transaction costs) of owning bullion.

You can also invest in gold miner stocks by purchasing the VanEck Gold Miners Equity ETF (GDX), which owns the world’s largest gold companies… or the VanEck Junior Gold Miners ETF (GDXJ), which focuses on small-cap gold miners.

As you can see below, both of these ETFs have outperformed gold over the past six months.

That’s because mining costs are relatively stable—so increases in the price of gold go directly to the miners’ bottom line.

These investments are a must for most portfolios as we head into a recessionary 2023.

Editor’s note:

Unlimited Income crushed the market last year… thanks to Genia’s time-tested strategy of buying dividend-growth stocks.

While most stocks crashed, the picks in the Unlimited Income portfolio outperformed the market by more than 20% (on average) in 2022.