Attention Unlimited Income members: Your August issue—and a new income stock idea—will be released on Tuesday, July 26—one week early.

Inflation is everywhere.

It erodes the value of savings… and reduces the purchasing power of current income.

It threatens consumer confidence… economic stability… and GDP growth.

And with inflation now at a 40-year high, the Fed can’t afford to keep waiting until it goes away on its own.

Historically, the only reliable way to fight inflation has been to slow the economy by pushing interest rates dramatically higher.

There’s no reason to expect this time will be any different.

This is why all eyes will be on the Federal Open Market Committee (FOMC) meeting next week. At its conclusion, FOMC—the decision-making arm of the Fed—is likely to hike the rates by 0.75%.

As dramatic as this move would be, the market already anticipated a massive 1% hike earlier this month… and stocks are rallying.

The Fed might surprise us with an even larger hike next week. But don’t make the mistake of thinking it will magically end inflation. A Fed Funds rate of 2.5% or 3%—when inflation is at 8.6%—won’t stop price increases in their tracks.

Our money will continue to lose purchasing power to inflation for the foreseeable future. And there’s no better way to combat the erosion than by being in the stock market (especially its income part).

The only reliable way to grow wealth

If you’re sitting in cash because you’re worried about the continued effects of inflation on the market—don’t. You can buy back your sold stocks… invest in new bargains created by the selloff… or start small with the help of exchange-traded funds (ETFs). Here are two I’d recommend…

No. 1: Vanguard Value ETF (VTV)

An easy, safe way to ease back into the market is with value stocks.

Many of these stocks are high-quality companies that simply fall on the cheaper side of the market.

Plus, value stocks pay dividends… and thus provide some stability in a volatile market.

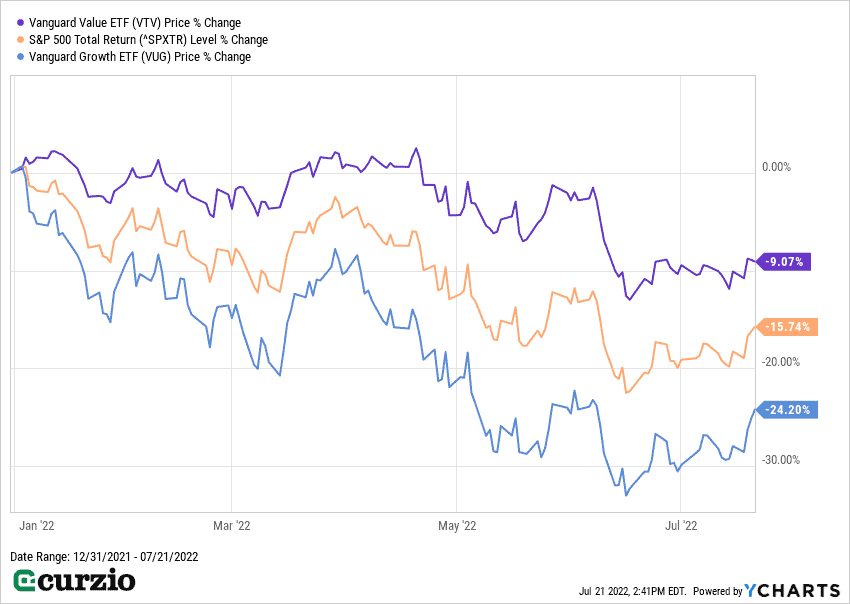

No wonder value stocks, like those comprising the VTV ETF, outperformed their growth siblings—and the market—in 2022.

The chart below illustrates this action.

Year to date, the Vanguard Value ETF lost about 9%… which, as you can see above, is much less than the overall market’s 16% or the growth sector’s 24.5%.

The top positions in the VTV fund are all familiar names. Of the top 5—United HealthCare (UNH), Berkshire Hathaway (BRK/B), Johnson & Johnson (JNJ), Exxon Mobil (XOM), and Procter & Gamble (PG)—only BRK/B doesn’t pay a dividend.

The other four are all dividend-paying and dividend-growing stocks. They all possess business moats… strong balance sheets… and can pay dividends at a growing pace.

Overall, the fund yields 2.5%—much better than the market’s 1.7%.

Because it’s an index-based fund, and Vanguard’s annual fee (a very low 0.04%) doesn’t detract from the yield, it has very little impact on the ETF’s performance.

Since its 2004 inception, the fund has returned 8.2% annually—much better than inflation, which has averaged about 2.4% over the same time.

That makes VTV a great fund for this market.

But if plain vanilla index funds are not your cup of tea, consider my second suggestion…

No. 2: VanEck Morningstar Wide Moat ETF (MOAT)

A so-called “blend” fund—a combination of growth and value—the MOAT ETF focuses on U.S. companies with sustainable competitive advantages, or “moats.”

Companies with moats—such as the ETF’s top stocks, Kellogg (K), Veeva Systems (VEEV), Biogen (BIIB), Gilead (GILD), and Polaris (PII)—all have the power of brand names or patent protection behind them… and can sustain their business growth even in the worst economic conditions.

Many also pay dividends—and MOAT generates a respectable 1.2% yield.

Morningstar’s moat rating ranks companies based on how well they can fend off competition. Long-term moats—the kind the MOAT ETF invests in—are expected to last 20 years and more…

These are strong businesses with high switching costs for their customers, significant cost advantages over the competition, intangible assets, and other advantages.

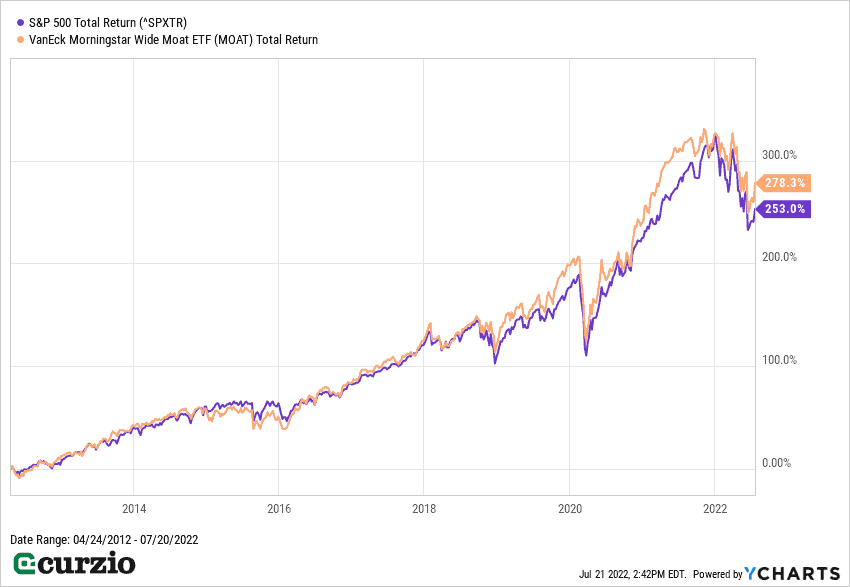

Since its inception (April 2012), MOAT has outperformed the market with an annualized return of 13.4%.

Year to date, MOAT has underperformed VTV—but not by much.

The two funds above will help you fight inflation by easing you into the market… via the best value and moat-protected stocks in the market.

Editor’s note:

In Unlimited Income, Genia just recommended a recession-ready stock that could not only make you a nice capital gain in the near future (no matter how crazy the market gets)…

It’ll also hand you cash payments every few months.

Learn how to access this stock… and a portfolio full of high-yield assets to grow your wealth in any market.