Prior to the New Millennium, investors had been pouring money into high-flying tech stocks. The market pinned its growth hopes on a motley crew of unprofitable, internet-adjacent companies. Most of them were still figuring out how to make money off this new phenomenon.

Traditional tech stocks were also flying. So high, in fact, that it took more than 10 years for software companies like Microsoft and Oracle to exceed their dot-com highs. And, if you don’t take dividends into consideration, hardware giants Intel and Cisco still trade below their 2000 peaks.

Towards the end of the ’90s, as fears of Y2K began to emerge, tech spending exploded as the world looked to prevent this major, potentially civilization-destroying bug.

But as the New Millennium arrived and it became clear the world was still spinning… there was no longer a clear and obvious reason for a massive hardware and software investment… and the tech rally started unraveling.

Two years after the turn of the millennium, the market was still down about 22%… and the tech-heavy Nasdaq was down more than 50%.

There are a few lessons from the dot-com bust and the Y2K bug that we can use in today’s market—to stay as safe as possible… while still positioned to make money:

1. Expectations matter… but valuations are just as important.

If expectations don’t materialize (as was the case for countless dot-com names) or if they decline sharply (like they did for many large-cap tech companies)… the market will have no mercy.

Combined with stretched valuations, it’s a dangerous scenario… and only a matter of time before the market snaps.

2. Over time, markets tend to move higher.

Even bear market selloffs don’t last forever. If you have a long-enough time horizon or don’t live off the market gains… opportunistic buys during large declines could pay off big.

Today, more than 21 years after the Y2K scare, we’re up multifold on all major indices.

3. When the market sells off, it could become very hard to hide… and very costly to hedge.

Even in a strong bull market, it’s critical to be prepared for the possibility of a downturn… Just like health insurance, it’s much better to buy market hedges when you don’t yet need them.

Trying to hedge in the middle of a market downturn can become expensive—or nearly impossible… The market is already scared and the prices of safe haven assets and put-based insurance tend to run high… making it hard to find safe assets (other than cash) that have not already rallied. (In the Y2K aftermath, for example, the entire market dropped.)

That’s why it’s always a good idea to carry some hedges—assets that move opposite to the rest of your portfolio—to act as insurance against market weakness.

Bonds to build market insurance

Bonds can serve as a hedge… as they often move in the opposite direction to stocks (one big reason financial advisors are so fond of so-called “60/40” portfolios).

Lately, this relationship has broken down, thanks to the Fed’s zero-rate policies… Stocks benefit from low rates because they thrive on cheap money…. and bonds, which always move in the opposite direction to interest rates, also rise when rates decline.

Still, there are several bonds that could serve as a portfolio hedge against inflation, one of the market’s foes.

Treasury inflation-protected securities (TIPS) are a special class of U.S. Treasury bonds… designed to deliver interest income that keeps up with the level of inflation.

First created in 1997 amid inflationary concerns, TIPS are now offered in 5-, 10-, and 30-year maturities.

The principal of a TIPS bond increases with inflation and decreases with deflation (as measured by the Consumer Price Index)… At maturity, a TIPS bond will pay the greater of either the adjusted principal or the original principal.

TIPS pay interest twice a year at a fixed rate. But because the rate is applied to the adjusted principal, interest payments will also rise with inflation (and fall with deflation).

So in inflationary environments, TIPS can be a better alternative to cash.

My favorite funds for inflation protection

One of the easiest ways to own TIPS is through an exchange-traded fund (ETF).

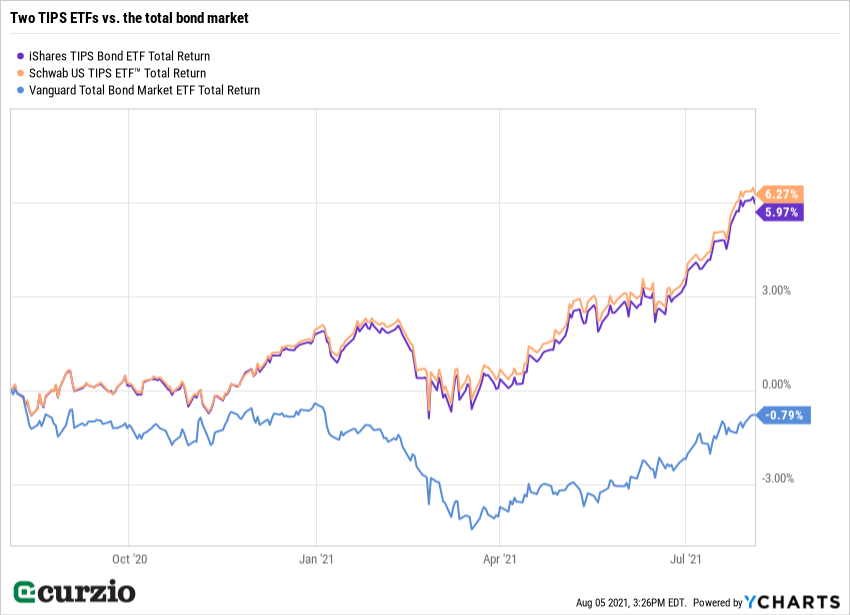

Two funds to consider would be the iShares TIPS Bond ETF (TIP) and the Schwab U.S. TIPS ETF (SCHP).

Over the past decade, these two ETFs delivered about a 35% total return (price appreciation plus dividend)—beating inflation if not the overall market.

Their 10-year performance is about the same as the Vanguard Total Bond ETF Index (BND). But they’ve started to pull ahead lately. They’ve easily outperformed BND over the past year… as inflation numbers started to surge. Both funds are up more than 6% over the past 12 months, including dividends. That’s a big return considering the overall bond market is in negative territory over the same period.

Remember: even though we haven’t seen a 5% market decline this year, it doesn’t mean we’re in for easy sailing. To stay safe, it’s important to be prepared for the unexpected… Protect yourself—your portfolio will thank you for it.

P.S. You don’t have to sacrifice safety to find growth in the markets.

In my Unlimited Income advisory, I uncover safe, inflation-ready assets… that deliver market-beating dividends… AND quick capital gains.

If you’re looking for that rare balance of income and growth… join me for 30 days risk-free. You’ll get immediate access to my portfolio… and my report, “Income Stocks to Buy & Avoid Today.”